The UK economy suffered its worst and biggest slump on record between April and June due to coronavirus lockdown measures, shrinking as much as 20.4 per cent compared with the first three months of the year. The UK is officially into recession. Household spending plunged as shops were ordered to close, while factory and construction…

Category: BANKING

The UK government borrowed £127.9bn between April and June for tackling the coronavirus pandemic, taking the total government debt to £1.98 trillion. The difference between spending and tax income was more than double the £55.4bn borrowed in the whole of the previous year. The borrowing in June was lower in May at £35.5bn, as…

Trade conflicts caused by governments promoting the interest of the elite at the expense of workers. Across the world, the rich have prospered while workers can no longer afford to buy what they produce have lost their jobs, or have been forced into higher levels of debt. The class wars of rising inequality are a…

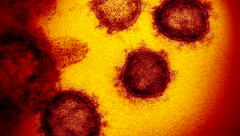

The UK has passed 300, 469 confirmed Covid-19 cases, as the average number of deaths from Covid-19 over the last seven days is now 144 compared with 435 on May 18. Britain faces a Tsunami of job losses despite hundreds of thousands of furloughed employees getting back to work. MPs were told that jobs were…

Vijay Mallya, the high-flying owner Kingfisher Airlines, on Thursday, lost his leave to appeal his extradition to India in the UK Supreme Court, triggering a 28-day clock on his removal from the UK. The extradition case regarding the alleged bank fraud of Rs 900 crore in IDBI Bank/ The liquor baron also faces probe in…

Chancellor Rishi Sunak announced the UK furlough scheme to pay wages of workers on leave because of coronavirus has been extended to October. He further said the government-backed workers and companies going into the lockdown, and would support them coming out and confirmed that employees will continue to receive 80 per cent of their monthly…

Protective screens and reduced hot-desking alternatives to social distancing where it is not possible are among measures being considered to let workplaces reopen. Reopening the economy will take more than modified working practices. Workers must be confident they are safe. Companies must be confident they won’t be sued if they get it wrong. And consumers…

FTSE100 giants Whitbread and Associated British Foods today lined up loans from the government as they handle mass store, hotel and restaurant closures. ABF which owns Primark which shut 186 stores, and Premier Inn owner, Whitbread who had been forced to shut 800 hotels, both said the Bank of England have confirmed they are…

MPs and firms have criticised banks for insisting on personal guarantees to issue government-backed emergency loans to business owners. The new requirement loads most of the risk that the loan goes bad on the business owner, rather than the banks, which means the banks can go after the personal property of the owner of a…

The Chancellor Rishi Sunak will today announce a package of support for Britain’s 5m self-employed people to help them through the coronavirus pandemic after Boris Johnson decreed they should have “parity of support” with employed counterparts. The self-employed would submit forms to HM Revenue & Customs, the tax authority, declaring their recent income, if there…