US tax code has one rule for the rich and another for the rest

Seventy one per cent of Americans believe the economy is rigged in favour of the rich starting with tax code.

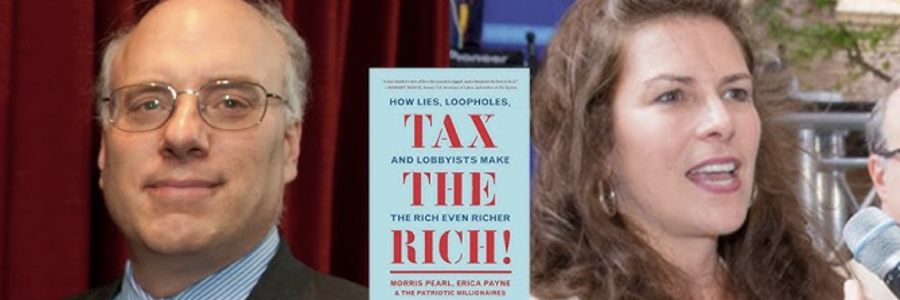

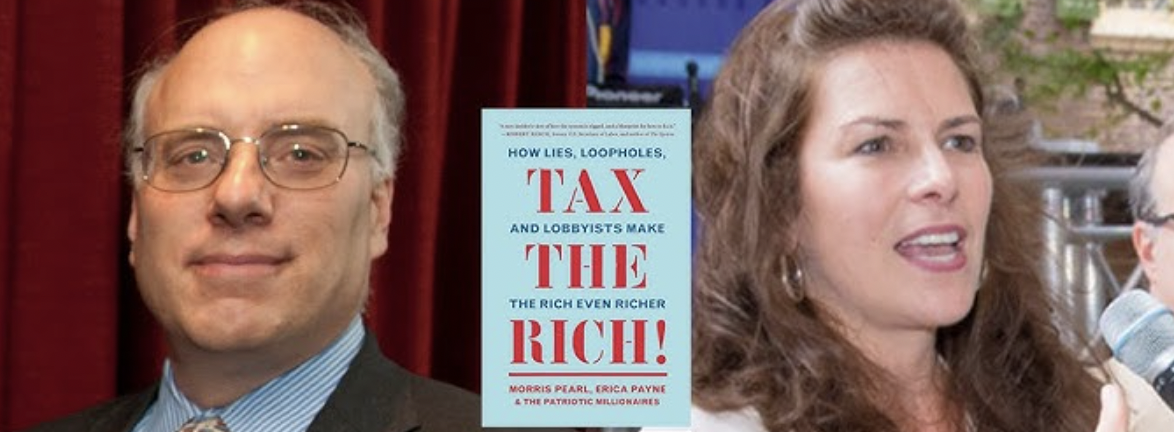

Former BlackRock executive Morris Pearl, the millionaire chair of the Patriotic Millionaires and Erica Payne, the organization’s founder, reveals and engaging and enlightening insider’s tour of th nations tax code, explaining how “the rich” manipulate the U.S. tax code to ensure the rich get richer and everyone else is left holding the bag.

Blunt and irreverent, Tax the Rich dismantles the intellectual justification for tax code that virtually guarantees destabilising levels of inequality and consequent social unrest.

In 2, 500 BC Sumerian clay tablets, recoding tax payments to Rosseta Stone, describing tax breaks for priests, taxation forms are defining forces of the history of civilisation.

The U.S. President Hoe Biden has vowed not to touch the payments of the middle class , instead target the rich and highly profitable companies to raise the funds for his infrastructure programme and to make America’s threadbare welfare state appear a little more European.

Republicans say Biden’s new taxes will destroy jobs, drive down wages and drive up the cost of living.

The digitisation of economies and footloose profits hs seen tech companies pay little tax, prompting governments to impose new levies on them, leading to trade tensions and threats of tariffs. Damaging trade wars are distinct possibility if the negotiations in Paris don’t succeed in finding a way to tax multinationals after a century of change.

Citizens now demand that governments ensure they can live their lives with more resilience against pandemics, global warning, and ageing populations.

Most citizens accept that the state needs revenues to finance public goods such as defence and policing, and essential services including health, education and social security. US Supreme Court Justice Oliver Wendell Holmes noted in 1927: “ Taxes are what we pay for civilised society”, yet voters tend to prefer taxes that other people pay. To ensure that they collect sufficient funds, government have historically imposed draconian penalties for those caught fiddling the system.

It is the combination for demand for money backed by menaces that led Edward Troup, the former head of UK Tax authority, to write the taxation is “legalised extortion” before he entered public service.

When the population rises up against what they see as unfair impositions of tax laws – whether it was George III’s rule over American colonies, Louis XVI in France or Margaret Thatcher’s poll tax- regimes and governments crumble.

Economists with their equations and dismal communication skills has long understood to have failed the day to day tax debates,

Tax the Rich, How Lies, Loopholes and Lobbyists Make the Rich Even Richer, written on behalf of Patriotic Millionaires, trying to persuade their fellow plutocrats to be taxed more. If readers are expecting a revolutionary manual for those wanting to get their hands on the money off those with megabucks they will be disappointed. Pearl who made his money from Wall Street, and Payne wrote the book rooted in fear that if America continues to avoid the question of taxing rich people more, they will suffer.

Pearl writes in defence of being called a “traitor to my class”, “ I don’t want to ride around town in a bulletproof car with a trained security guard. I don’t want to worry that my children or grandchildren are going to get kidnapped or worse”.

The book focuses its anger at the way political funding, lobbying and shamelessness, had led to massive opportunities for legal tax avoidance, ensuring that the US tax code in effect, has one rule for the rich and another for most citizens.

Biden administration has proposed to close many of the loopholes, they criticise the ability of people in finance to dress up salary as capital gains and the creation of a minimum corporate income tax rate on global profits, eliminating the ability of US companies to shift profits to tax haven.

The book failed to consider whether multimillionaires deserve their riches, but merely seeks to tax away some of the gains and reveals a naive faith in government that the authors think it can tax the rich effectively, when many of them achieved their wealth through the same lobbying politicians, the exploitation of uncompetitive markets an even crony capitalism.

Tax The Rich! How Lies, Loopholes and Lobbyist Make the Rich Even Richer by Morris Pearl, Erica Payne and The Patriotic Millionaires, New Press $17.99/£12.99, 272 pages.